Below is a sample of the emails you can expect to receive when signed up to Cannon Trading.

|

CME Group Raises Data Fees & Transaction Fees for Stock Index Futures + Investors Fearful of Geopolitical Risk have made the Swiss Franc Hideout Spot.

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

CME Group Raises Data Fees & Transaction Fees for Stock Index Futures + Investors Fearful of Geopolitical Risk have made the Swiss Franc Hideout Spot.

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

Why do most futures traders lose money and how can you improve your odds? + $10 Move Down on Crude Oil Futures last 2 weeks!

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Hi Luke,

Ilan (pronounced Elan) here with Cannon Trading

(one of the first online futures trading companies and in business since 1988)

Thank you for visiting our website and inquiring about our futures trading services!

Cannon Trading has a lot to offer over the competition:

*Licensed series 3 account representative.

*Low day trading margins!

*Competitive commissions!

*Multiple choice of platforms.

* Award winning services.

* Vast educational resources.

Here is what you can have by becoming a client of Cannon Trading:

You can

open an account online in less than 15 minutes!

In order for me to assist you in a personal matter, please take a minute and reply back to questions below:

1. Have you traded futures before?

2. Are you using a WINDOWS PC or a MAC computer?

3. What markets interest you at this time?

4. Are you planning to daytrade, longer term trades? options/futures?

5. What is the amount of capital you are planning to open an account with?

6. Have you taken a course or been mentored by anyone?

I look forward to future conversations so I can provide you with more details.

Good Trading,

Ilan Levy-Mayer

Cannon Trading Company

9301 Wilshire Blvd., Suite No. 515

Beverly Hills, CA 90210

Phone: (800) 454 – 9572 | (310) 859 – 9572

Skype:

ilanlevymayer

Fax: (310) 859 – 0547

![]()

![]()

![]()

Important: Trading commodity futures and options involves a substantial risk of loss. The recommendations contained in this letter are of opinion only and do not

guarantee any profits. There is not an actual account trading these recommendations. These are risky markets and only risk capital should be used. Past performances are not necessarily indicative of future results.

|

Webinar Tomorrow: Top 7 trading set ups

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

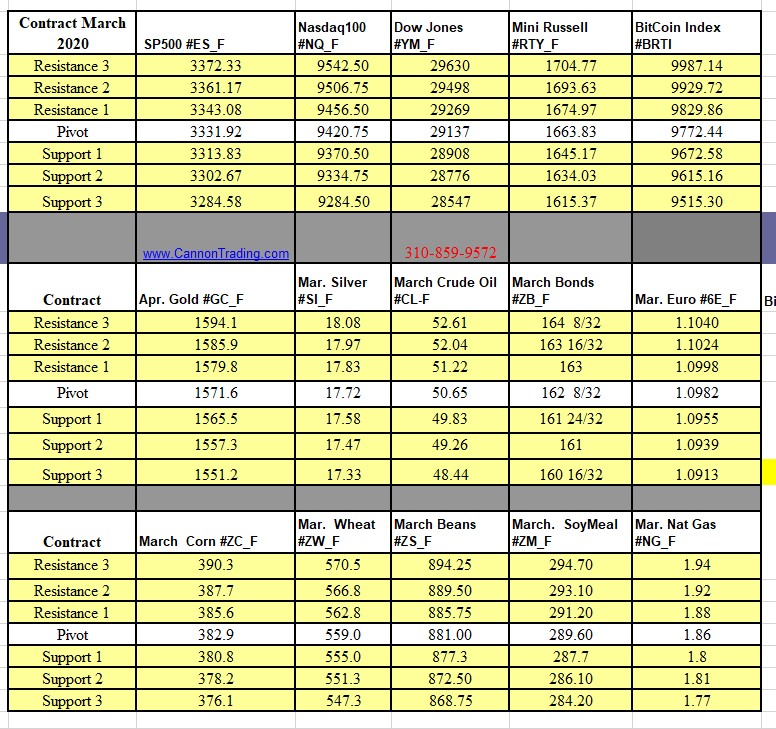

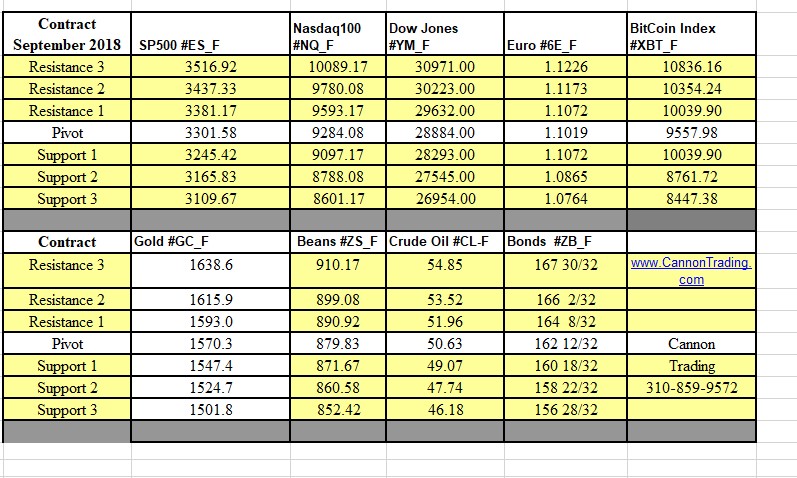

Trading Hours & Levels for Tomorrow

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

Trading Hours & Levels for Tomorrow

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

Futures Diversification Solutions - Cannon Trading

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

Special 1000th edition!! How the "Fed Juice" affects the markets? + FREE tools, resources and more!

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

Futures Trading Resources & Levels for Tomorrow

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

Futures Trading Valuable Info+Futures Trading Levels for 5-25-2020

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

Futures Trading Resources & Levels for Tomorrow

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

Cannon Trading Annual Privacy Statement

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

Futures Trading Valuable Info+Futures Trading Levels for Tomorrow

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

Futures Levels for Tomorrow + What Futures traders Need to Know!

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

LIMITS & Circuit Breakers & Levels for Tomorrow

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

Trading Videos: Using Volume Charts, Bollinger Bands + Futures Levels 11.16.2020

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

Futures Trading Valuable Info+Futures Trading Levels for Tomorrow

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

Why do Most Futures Traders Lose Money & How Can You Improve Your Odds? - Crude Oil Futures to Break Out?

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

Next Round of Stimulus: Where are the 10 year Notes Headed? + Futures Trading Levels for August 10th, 2020

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

Volatile Days Could be Ahead + FREE tools, resources and more!

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

Trading Hours & Levels for Tomorrow

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

Futures Levels for Tomorrow + Valuable Info

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

5 Big Mistakes Beginners Should Avoid Making + Bitcoin Futures Almost Double in 2 Months

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

Futures Levels for Tomorrow + The Small Exchange

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

Resources to Help You Navigate These Turbulent Times + Crude Oil Futures...Negative Prices and More

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

Futures Trading Valuable Info+Futures Trading Levels for Tomorrow

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

Small Exchange Precious Metals Index + Futures Trading Levels for August 17th, 2020

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

Futures Trading Valuable Info+Futures Trading Levels for Tomorrow

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

Trading Resources, Levels and more for next week!

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

Futures Trading Valuable Info+Futures Trading Levels for Tomorrow

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

How Will Tomorrow's Elections Affect the Markets?

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

Trading Resources, Levels and more for next week!

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

Levels for June 22nd

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

Corn Futures Breaking above $4 per Bushel + Futures Levels 10.19.2020

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

Trading Information & Futures Levels for Tomorrow

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

Using Tick/Volume charts and Oscillators for Scalping + Crude Oil Futures...More Volatility Ahead?

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

Trading Hours & Levels for Tomorrow

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

Futures Trading Valuable Info+Futures Trading Levels for Tomorrow

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

Futures Trading Resources + Futures Levels 11.02.2020

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

Why do most futures traders lose money and how can you improve your odds? !

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

Do you feel the same about your broker? Futures Levels for Tomorrow

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

FREE eBook, Weekly & Daily Futures Trading Levels

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

Day Trading Mind Traps, Precious Metals + Futures Trading Levels for August 3rd, 2020

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

Get Real Time Trade Alerts Directly To Your Phone & Will USDA WASDE change the Bean Oil Trend?

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

Trading Hours & Levels for Tomorrow

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

Day Trading Mind Traps + Silver Futures Between Major Weekly Levels

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

Futures Trading Resources + Futures Levels 10.26.2020

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

Trading Hours & Levels for Tomorrow

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

Futures Levels for Tomorrow + The Small Exchange

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

Learn to Take a Loss + Stock Index Futures and Stock Market - Whats next.....

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

Futures Levels for Tomorrow + The Small Exchange

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

Trading Hours & Levels for Tomorrow

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

Futures Levels for Tomorrow + Valuable Trading Resources

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

8 Steps to Building a Better Trading Foundation & Silver Futures Surge Higher

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

Trading Resources, Levels and more for next week!

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

FREE 93 Page Booklet on Opportunities and Risk + Futures Levels 11.23.2020

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

Day-Trading Alerts via Text Directly to Your Phone FREE TRIAL ($249 value) - Copper Futures Rally on Good Volume

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

How Will Trump/COVID affect the Markets? + FREE tools, resources and more!

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

ES Futures Sitting on Major Pivot Line

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

Recognizing Chart Patterns - Position Traders Watch Keys in the Crude Oil Market

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

Copper Chart, Weekly & Daily Futures Trading Levels

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

Futures Trading Valuable Info+Futures Trading Levels for Tomorrow

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

How the "Fed Juice" affects the markets? + FREE tools, resources and more!

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

Futures Trading Valuable Info+Futures Trading Levels for Tomorrow

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

Options on Futures In Depth Information + US Treasury Bonds Acting as Main Safe Haven

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

Important trading information & Levels for Monday

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

Trading Resources, Levels and more for next week!

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

Using tick and volume charts for day trading

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

Futures Trading Valuable Info+Futures Trading Levels for Tomorrow

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

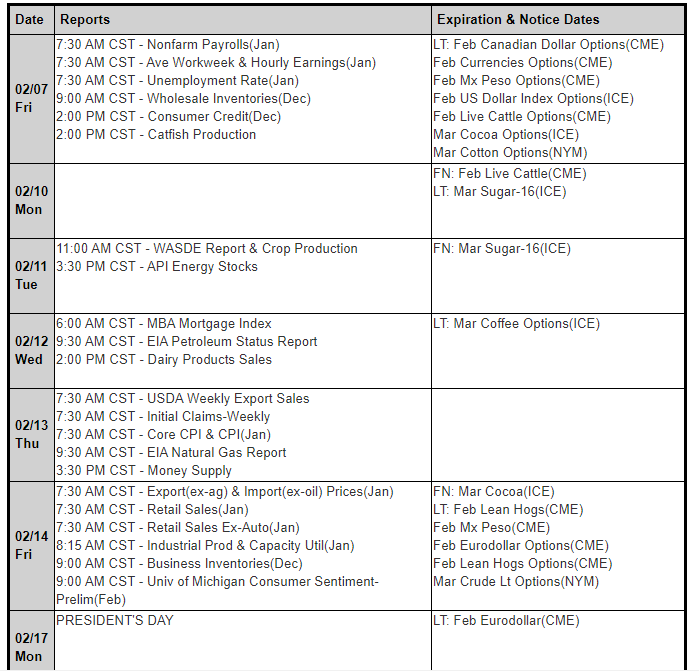

Trading Economic Reports - Free Premium Guide+Futures Trading Levels for 6-01-2020

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

Futures Trading Valuable Info+Futures Trading Levels for Tomorrow

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

Futures Levels for Tomorrow + Valuable Info

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

Seasoned brokers at your fingertips +Futures Trading Levels for Tomorrow

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

Trading Hours & Levels for Tomorrow

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

Futures Trading Resources & Levels for Tomorrow

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

Happy Holidays and a Healthy New year!

|

||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||

|

|

Futures Trading Resources & Levels for Tomorrow

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

Day Trading Futures vs. ETS, Stocks, Weekly & Daily Futures Trading Levels

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

| Data Name | Data Type | Options |

|---|---|---|

| Have you traded before? | ||

| First name | ||

| Last name | ||

| Phone (mobile) | ||

| Phone | ||

| --None-- | ||

| --None-- | ||

| --None-- | ||

| 0-10 Round Turns 10-50 Round Turns 50-100 Round Turns 100-250 Round Turns 250+ Round Turns Markets Traded | ||

| Minis | ||

| Metals | ||

| Options | ||

| Currencies | ||

| Energies | ||

| Indices | ||

| Meats | ||

| Softs | ||

| --None-- | ||

| --None-- | ||

| --None-- | ||

| --None-- | ||

Arts and Entertainment

Arts and Entertainment Business and Industry

Business and Industry Computer and Electronics

Computer and Electronics Games

Games Health

Health Internet and Telecom

Internet and Telecom Shopping

Shopping Sports

Sports Travel

Travel More

More